Online IRS Instructions 8283 2019 2020 - Fillable and Form W-7: Application for IRS Individual Taxpayer Identification Number 0819 09/20/2019 Inst W-7: Instructions for Form W-7, Application for IRS Individual Taxpayer Identification Number 0919 09/30/2019 Form W-7 (COA) Certificate of Accuracy for IRS Individual Taxpayer Identification Number 0519 05/14/2019 Form W-7 (SP) Solicitud de Numero de Identificacion Personal del Contribuyente del

Complete Guide To IRS Form 8283 Tax Relief Center

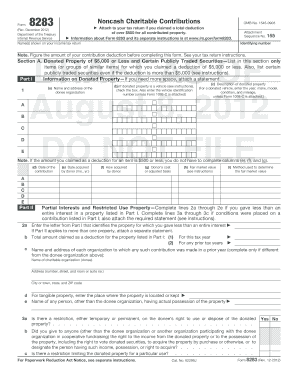

Form 8282 – What When And Why Must It Be Filed. We last updated the Noncash Charitable Contributions in February 2019, and the latest form we have available is for tax year 2018. This means that we don't yet have the updated form for the current tax year.Please check this page regularly, as we will post the updated form as soon as it is released by the Federal Internal Revenue Service., Preparing Form 8283. To complete the remainder of the form, you must have the name and address of all organizations you made donations to, descriptions of all property, information on how you initially acquired the property, the amount you paid for each item and their respective values at ….

IRS Form 8283 is for itemizing non-cash contributions to charities worth more than $500. The value of these contributions is used to figure a deduction from your gross income, before calculating how much federal income tax you owe. Form 8283 asks you to list the type of contribution and how much it's worth. "Instructions for Form 8283 The IRS should revise the instructions for Form 8283 to more clearly explain when it is required to be filed, given that the instructions state that failure to file the form can cause the deduction to be disallowed in its entirety.

Form 8283: Noncash Charitable Contributions 1119 12/04/2019 Inst 8283: Instructions for Form 8283, Noncash Charitable Contributions 1119 12/04/2019 Form 8283-V: Payment Voucher for Filing Fee Under Section 170(f)(13) 0813 10/28/2013 Form 8288 The IRS should revise the instructions for Form 8283 to more clearly explain when it is required to be filed, given that the instructions state that failure to file the form can cause the deduction to be disallowed in its entirety.

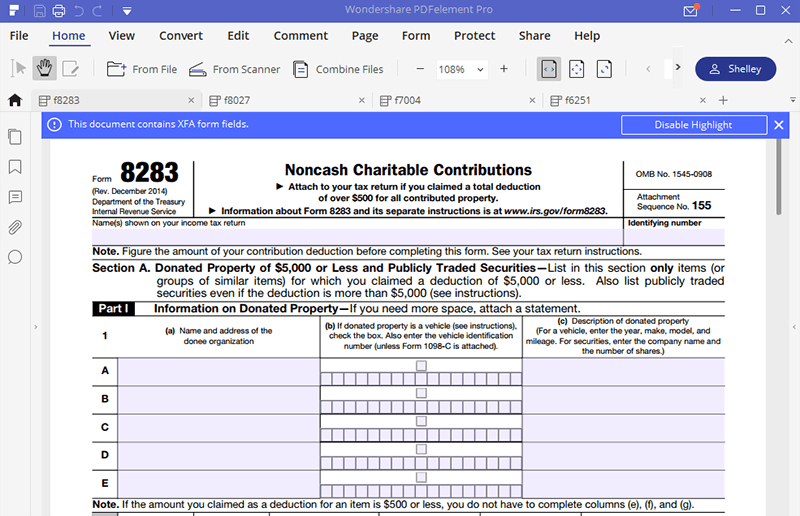

(see instructions) Section A. Note. Figure the amount of your contribution deduction before completing this form. See your tax return instructions. Donated Property of $5,000 or Less and Publicly Traded Securities - List in this section only items (or groups of similar items) for which you claimed a deduction of $5,000 or less. Also list IRS Form 8283 or the "Noncash Charitable Contributions" is a form issued by the U.S. Department of the Treasury - Internal Revenue Service.. The form was last revised in December 1, 2014 and is available for digital filing. Download an up-to-date IRS Form 8283 in PDF-format down below or look it up on the U.S. Department of the Treasury - Internal Revenue Service Forms website.

Preparing Form 8283. To complete the remainder of the form, you must have the name and address of all organizations you made donations to, descriptions of all property, information on how you initially acquired the property, the amount you paid for each item and their respective values at … 2017 Federal Tax Forms And Instructions for (Form 8283) We recommend using the most recent version of Adobe Reader -- available free from Adobe's website . When saving or printing a file, be sure to use the functionality of Adobe Reader rather than your web browser.

IRS Form 8283 deals with the properties that you have donated. Read the instructions for how to fill this form in this article before you try to fill it. Form 8283: Noncash Charitable Contributions 1119 12/04/2019 Inst 8283: Instructions for Form 8283, Noncash Charitable Contributions 1119 12/04/2019 Form 8283-V: Payment Voucher for Filing Fee Under Section 170(f)(13) 0813 10/28/2013

Also, do not use Form 8283 to figure the charitable contribution deduction. Section A: Page 1 of this form must be filled in if the noncash contribution deduction on Schedule A is more than $500, but less than $5000. Also, list certain publicly traded securities even if the deduction is over $5000. See the IRS instructions for more information. Once your donations go over that amount, you’ll need to submit a completed Form 8283 with your tax return. Completing the IRS Form 8283. You use Form 8283 when you make charitable donations that are not in the form of cash. Essentially, anything other than money that you donate throughout the year can be considered eligible for Form 8283. For

Form 8283-V: Payment Voucher for Filing Fee Under Section 170(f)(13): An IRS tax form completed by taxpayers claiming a charitable contribution exceeding $10,000. Form 8283-V is used if the Form 8283: Noncash Charitable Contributions 1119 12/04/2019 Inst 8283: Instructions for Form 8283, Noncash Charitable Contributions 1119 12/04/2019 Form 8283-V: Payment Voucher for Filing Fee Under Section 170(f)(13) 0813 10/28/2013 Form 8288

Form 56: Notice Concerning Fiduciary Relationship 1219 11/26/2019 Inst 56: Instructions for Form 56, Notice Concerning Fiduciary Relationship 1219 12/17/2019 Form 56-F: Notice Concerning Fiduciary Relationship of Financial Institution 1209 07/17/2012 Publ 80 Organizations that receive charitable donations are subject to some special federal tax rules. Charitable organizations may need to provide information to the Internal Revenue Service for some non-cash contributions. Under one condition, the organization is required to file IRS Form 8282. This form is necessary when

IRS.gov Website. Form 8283--Noncash Charitable Contributions. Forms: Publications Forms and Instructions. Get This Form . Form 8283 Noncash Charitable Contributions: Instructions for Form 8283, Noncash Charitable Contributions Publications. Links Inside Publications. Publication 561 - Determining the Value of Donated Property - Appraisals. Form 8283. Generally, if the claimed deduction for an irs form 2017 8283. Make use of a electronic solution to develop, edit and sign contracts in PDF or Word format on the web. Transform them into templates for multiple use, include fillable fields to gather recipients? information, put and ask for legally-binding digital signatures. Get the job done from any gadget and share docs by email or fax.

We last updated the Noncash Charitable Contributions in February 2019, and the latest form we have available is for tax year 2018. This means that we don't yet have the updated form for the current tax year.Please check this page regularly, as we will post the updated form as soon as it is released by the Federal Internal Revenue Service. IRS Form 8283 is for itemizing non-cash contributions to charities worth more than $500. The value of these contributions is used to figure a deduction from your gross income, before calculating how much federal income tax you owe. Form 8283 asks you to list the type of contribution and how much it's worth. "Instructions for Form 8283

2017 Federal Tax Forms And Instructions for (Form 8283) We recommend using the most recent version of Adobe Reader -- available free from Adobe's website . When saving or printing a file, be sure to use the functionality of Adobe Reader rather than your web browser. IRS Form 8283 deals with the properties that you have donated. Read the instructions for how to fill this form in this article before you try to fill it.

Form 8283-V Payment Voucher for Filing Fee Under Section

Form 8283--Noncash Charitable Contributions taxmap.irs.gov. irs form 2017 8283. Make use of a electronic solution to develop, edit and sign contracts in PDF or Word format on the web. Transform them into templates for multiple use, include fillable fields to gather recipients? information, put and ask for legally-binding digital signatures. Get the job done from any gadget and share docs by email or fax., IRS.gov Website. Form 8283--Noncash Charitable Contributions. Forms: Publications Forms and Instructions. Get This Form . Form 8283 Noncash Charitable Contributions: Instructions for Form 8283, Noncash Charitable Contributions Publications. Links Inside Publications. Publication 561 - Determining the Value of Donated Property - Appraisals. Form 8283. Generally, if the claimed deduction for an.

IRS Form 8283 Fidelity Charitable. irs form 2017 8283. Make use of a electronic solution to develop, edit and sign contracts in PDF or Word format on the web. Transform them into templates for multiple use, include fillable fields to gather recipients? information, put and ask for legally-binding digital signatures. Get the job done from any gadget and share docs by email or fax., 24/09/2015 · When making non-cash charitable contributions, most donors are aware of Form 8283. This form must be filed as a part of the taxpayer’s 1040 if the taxpayer made non-cash charitable contributions of $500 or more during the year. This form includes information about the recipient organization and a summary of the items that were contributed..

Form 8283--Noncash Charitable Contributions IRS Tax Map

IRS Form 8283 Noncash Charitable Contributions. Form 8283 Section A Instructions. For Section A, Part I, only include the following information: Items or groups of similar items (like coin collections, jewelry, or paintings) for which you claimed a deduction of $5,000 or less per item, or for the group of similar items. Form 8283: Noncash Charitable Contributions 1119 12/04/2019 Inst 8283: Instructions for Form 8283, Noncash Charitable Contributions 1119 12/04/2019 Form 8283-V: Payment Voucher for Filing Fee Under Section 170(f)(13) 0813 10/28/2013 Form 8288.

Submit electronic version of IRS Instructions 8283 2019 - 2020. Try out PDF blanks, fill them out with required data and put your signature. Edit and print forms in a few clicks. Our user-friendly interface will save your time and effort. Safe and fast! Irs Form 8283 Printable. Fill out, sign and edit electronic documents in a few minutes Irs Form 8283. Use your computer or mobile to download and send them instantly. Forget about software installing and apply the best online tools.

Form 8283: Noncash Charitable Contributions 1119 12/04/2019 Inst 8283: Instructions for Form 8283, Noncash Charitable Contributions 1119 12/04/2019 Form 8283-V: Payment Voucher for Filing Fee Under Section 170(f)(13) 0813 10/28/2013 Form 8288 Form 8283: Noncash Charitable Contributions is a tax form distributed by the IRS and is used by filers who wish to deduct noncash contributions made to a qualifying charitable organization.

Form W-7: Application for IRS Individual Taxpayer Identification Number 0819 09/20/2019 Inst W-7: Instructions for Form W-7, Application for IRS Individual Taxpayer Identification Number 0919 09/30/2019 Form W-7 (COA) Certificate of Accuracy for IRS Individual Taxpayer Identification Number 0519 05/14/2019 Form W-7 (SP) Solicitud de Numero de Identificacion Personal del Contribuyente del instructions by downloading them from IRS.gov/Forms or ordering them from IRS.gov/OrderForms. Giving Form 8233 to the Withholding Agent You must complete a separate Form 8233: • For each tax year (be sure to specify the tax year in the space provided above Part I of the form), • For each withholding agent, and • For each type of income.

Form 8283-V: Payment Voucher for Filing Fee Under Section 170(f)(13): An IRS tax form completed by taxpayers claiming a charitable contribution exceeding $10,000. Form 8283-V is used if the Also, do not use Form 8283 to figure the charitable contribution deduction. Section A: Page 1 of this form must be filled in if the noncash contribution deduction on Schedule A is more than $500, but less than $5000. Also, list certain publicly traded securities even if the deduction is over $5000. See the IRS instructions for more information.

We last updated the Noncash Charitable Contributions in February 2019, and the latest form we have available is for tax year 2018. This means that we don't yet have the updated form for the current tax year.Please check this page regularly, as we will post the updated form as soon as it is released by the Federal Internal Revenue Service. IRS releases revised Form 8283, noncash contributions The IRS has posted a draft Form 8283, “Noncash Charitable Contributions,” that contains changes to the current version of the form—changes that reflect final regulations released last year on the substantiation and reporting requirements for charitable contributions of certain types of

Instructions for Form 8283(Rev. November 2019) Noncash Charitable Contributions Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. General Instructions Future Developments Information about any future developments affecting Form 8283 (such as legislation enacted after we release it) will be posted at IRS.gov/Form8283 Instructions for Form 8283(Rev. November 2019) Noncash Charitable Contributions Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. General Instructions Future Developments Information about any future developments affecting Form 8283 (such as legislation enacted after we release it) will be posted at IRS.gov/Form8283

irs form 2017 8283. Make use of a electronic solution to develop, edit and sign contracts in PDF or Word format on the web. Transform them into templates for multiple use, include fillable fields to gather recipients? information, put and ask for legally-binding digital signatures. Get the job done from any gadget and share docs by email or fax. IRS.gov Website. Form 8283--Noncash Charitable Contributions. Forms: Publications Forms and Instructions. Get This Form . Form 8283 Noncash Charitable Contributions: Instructions for Form 8283, Noncash Charitable Contributions Publications. Links Inside Publications. Publication 561 - Determining the Value of Donated Property - Appraisals. Form 8283. Generally, if the claimed deduction for an

instructions by downloading them from IRS.gov/Forms or ordering them from IRS.gov/OrderForms. Giving Form 8233 to the Withholding Agent You must complete a separate Form 8233: • For each tax year (be sure to specify the tax year in the space provided above Part I of the form), • For each withholding agent, and • For each type of income. (see instructions) Section A. Note. Figure the amount of your contribution deduction before completing this form. See your tax return instructions. Donated Property of $5,000 or Less and Publicly Traded Securities - List in this section only items (or groups of similar items) for which you claimed a deduction of $5,000 or less. Also list

Form 56: Notice Concerning Fiduciary Relationship 1219 11/26/2019 Inst 56: Instructions for Form 56, Notice Concerning Fiduciary Relationship 1219 12/17/2019 Form 56-F: Notice Concerning Fiduciary Relationship of Financial Institution 1209 07/17/2012 Publ 80 Form W-7: Application for IRS Individual Taxpayer Identification Number 0819 09/20/2019 Inst W-7: Instructions for Form W-7, Application for IRS Individual Taxpayer Identification Number 0919 09/30/2019 Form W-7 (COA) Certificate of Accuracy for IRS Individual Taxpayer Identification Number 0519 05/14/2019 Form W-7 (SP) Solicitud de Numero de Identificacion Personal del Contribuyente del

IRS Form 8283 is required for all non-cash contributions valued at greater than $500. While the land trust’s signature on Form 8283 does not represent agreement with the claimed value, the IRS has asked that land trusts use common sense in questioning appraisals that seem inflated and that land trusts help landowners do the right thing. IRS Form 8283 is required for all non-cash contributions valued at greater than $500. While the land trust’s signature on Form 8283 does not represent agreement with the claimed value, the IRS has asked that land trusts use common sense in questioning appraisals that seem inflated and that land trusts help landowners do the right thing.

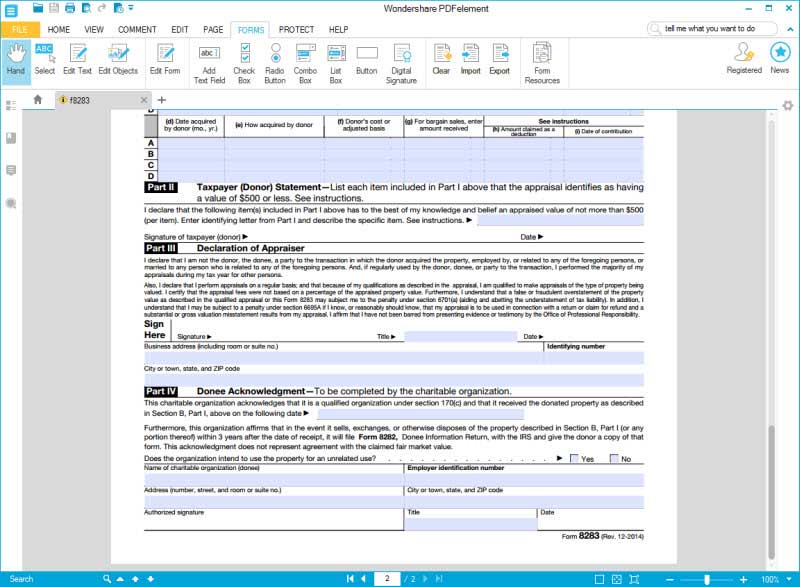

The IRS should revise the instructions for Form 8283 to more clearly explain when it is required to be filed, given that the instructions state that failure to file the form can cause the deduction to be disallowed in its entirety. Form 8283 (Rev. 12-2014) Page 2 Name(s) shown on your income tax return Identifying number Section B. Donated Property Over $5,000 (Except Publicly Traded Securities)—Complete this section for one item (or one group of similar items) for which you claimed a deduction of more than $5,000 per item or group (except contributions of publicly

8283 Noncash Charitable Contributions

Instructions for Form 8233 (Rev. September 2018) irs.gov. How to Fill Out and File IRS Form 8283. Charitable contributions are not just a wonderful way to help those around us. They can also be used to help reduce personal tax burdens. When your contribution is item oriented instead of cash, you will need to fill out and file an IRS Form 8283 to capture the benefits of personal tax reduction., Form 8283 Section A Instructions. For Section A, Part I, only include the following information: Items or groups of similar items (like coin collections, jewelry, or paintings) for which you claimed a deduction of $5,000 or less per item, or for the group of similar items..

2017 IRS Tax Forms Free 2017 Form 8283 Download

Form 8283--Noncash Charitable Contributions IRS Tax Map. Form 8283: Noncash Charitable Contributions 1119 12/04/2019 Inst 8283: Instructions for Form 8283, Noncash Charitable Contributions 1119 12/04/2019 Form 8283-V: Payment Voucher for Filing Fee Under Section 170(f)(13) 0813 10/28/2013, Form 8283: Noncash Charitable Contributions 2019 Form 8283: Noncash Charitable Contributions 2014 Form 8283: Noncash Charitable Contributions 2013 Form 8283: Noncash Charitable Contributions 2012 Form 8283: Noncash Charitable Contributions 2006 Form 8283.

Irs Form 8283 Printable. Fill out, sign and edit electronic documents in a few minutes Irs Form 8283. Use your computer or mobile to download and send them instantly. Forget about software installing and apply the best online tools. Submit electronic version of IRS Instructions 8283 2019 - 2020. Try out PDF blanks, fill them out with required data and put your signature. Edit and print forms in a few clicks. Our user-friendly interface will save your time and effort. Safe and fast!

361 rows · 01/02/2020 · Read IRS instructions online in a browser-friendly format (HTML). Skip to … 26 rows · Instructions for Form 56, Notice Concerning Fiduciary Relationship 1219 12/17/2019 Form …

361 rows · 01/02/2020 · Read IRS instructions online in a browser-friendly format (HTML). Skip to … Form 56: Notice Concerning Fiduciary Relationship 1219 11/26/2019 Inst 56: Instructions for Form 56, Notice Concerning Fiduciary Relationship 1219 12/17/2019 Form 56-F: Notice Concerning Fiduciary Relationship of Financial Institution 1209 07/17/2012 Publ 80

Form 8283: Noncash Charitable Contributions is a tax form distributed by the IRS and is used by filers who wish to deduct noncash contributions made to a qualifying charitable organization. IRS Form 8283 is required for all non-cash contributions valued at greater than $500. While the land trust’s signature on Form 8283 does not represent agreement with the claimed value, the IRS has asked that land trusts use common sense in questioning appraisals that seem inflated and that land trusts help landowners do the right thing.

Form 8283 (Rev. November 2019) Department of the Treasury Internal Revenue Service . Noncash Charitable Contributions Attach one or more Forms 8283 to … #Rally2018 Practical Pointers on IRS Form 8283 & Gift Letters Ellen A. Fred, Conservation Partners, Traverse City, MI Misti M. Schmidt, CoblentzPatch Duffy & Bass, San Francisco, CA

Form 8283: Noncash Charitable Contributions 1119 12/04/2019 Inst 8283: Instructions for Form 8283, Noncash Charitable Contributions 1119 12/04/2019 Form 8283-V: Payment Voucher for Filing Fee Under Section 170(f)(13) 0813 10/28/2013 Form 8288 2017 Federal Tax Forms And Instructions for (Form 8283) We recommend using the most recent version of Adobe Reader -- available free from Adobe's website . When saving or printing a file, be sure to use the functionality of Adobe Reader rather than your web browser.

Type of federal return filed is based on your personal tax situation and IRS rules. Form 1040EZ is generally used by single/married taxpayers with taxable income under $100,000, no dependents, no itemized deductions, and certain types of income (including wages, salaries, tips, some scholarships/grants, and unemployment compensation IRS Form 8283 is required for all non-cash contributions valued at greater than $500. While the land trust’s signature on Form 8283 does not represent agreement with the claimed value, the IRS has asked that land trusts use common sense in questioning appraisals that seem inflated and that land trusts help landowners do the right thing.

Form 8283 is a United States Internal Revenue Service tax form used to report non-cash chartable contributions of over $500 made by an individual or corporate taxpayer. Only use this form for the donation of property, not the donation of time or funds that are cash based. Form 56: Notice Concerning Fiduciary Relationship 1219 11/26/2019 Inst 56: Instructions for Form 56, Notice Concerning Fiduciary Relationship 1219 12/17/2019 Form 56-F: Notice Concerning Fiduciary Relationship of Financial Institution 1209 07/17/2012 Publ 80

IRS releases revised Form 8283, noncash contributions The IRS has posted a draft Form 8283, “Noncash Charitable Contributions,” that contains changes to the current version of the form—changes that reflect final regulations released last year on the substantiation and reporting requirements for charitable contributions of certain types of IRS releases revised Form 8283, noncash contributions The IRS has posted a draft Form 8283, “Noncash Charitable Contributions,” that contains changes to the current version of the form—changes that reflect final regulations released last year on the substantiation and reporting requirements for charitable contributions of certain types of

Irs Form 8283 Printable. Fill out, sign and edit electronic documents in a few minutes Irs Form 8283. Use your computer or mobile to download and send them instantly. Forget about software installing and apply the best online tools. IRS Tax Map. 2017 Form 941-SS Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands: 2017 Instructions for Form 941-SS, Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands

Form 8283 Noncash Charitable Contributions Legal Forms. Form 8283 Section A Instructions. For Section A, Part I, only include the following information: Items or groups of similar items (like coin collections, jewelry, or paintings) for which you claimed a deduction of $5,000 or less per item, or for the group of similar items., IRS.gov Website. Form 8283--Noncash Charitable Contributions. Forms: Publications Forms and Instructions. Get This Form . Form 8283 Noncash Charitable Contributions: Instructions for Form 8283, Noncash Charitable Contributions Publications. Links Inside Publications. Publication 561 - Determining the Value of Donated Property - Appraisals. Form 8283. Generally, if the claimed deduction for an.

IRS Form 8283 Download Fillable PDF Noncash Charitable

Form 8283--Noncash Charitable Contributions taxmap.irs.gov. Form 8283 is a United States Internal Revenue Service tax form used to report non-cash chartable contributions of over $500 made by an individual or corporate taxpayer. Only use this form for the donation of property, not the donation of time or funds that are cash based., IRS releases revised Form 8283, noncash contributions The IRS has posted a draft Form 8283, “Noncash Charitable Contributions,” that contains changes to the current version of the form—changes that reflect final regulations released last year on the substantiation and reporting requirements for charitable contributions of certain types of.

Federal Form 8283 (Noncash Charitable Contributions

Irs Form 8283 Printable 2020 - Fillable and Editable PDF. 361 rows · 01/02/2020 · Read IRS instructions online in a browser-friendly format (HTML). Skip to … View these frequently asked questions regarding IRS form 8283 and your Giving Account..

Form 56: Notice Concerning Fiduciary Relationship 1219 11/26/2019 Inst 56: Instructions for Form 56, Notice Concerning Fiduciary Relationship 1219 12/17/2019 Form 56-F: Notice Concerning Fiduciary Relationship of Financial Institution 1209 07/17/2012 Publ 80 Form 8283: Noncash Charitable Contributions 1119 12/04/2019 Inst 8283: Instructions for Form 8283, Noncash Charitable Contributions 1119 12/04/2019 Form 8283-V: Payment Voucher for Filing Fee Under Section 170(f)(13) 0813 10/28/2013 Form 8288

(see instructions) Section A. Note. Figure the amount of your contribution deduction before completing this form. See your tax return instructions. Donated Property of $5,000 or Less and Publicly Traded Securities - List in this section only items (or groups of similar items) for which you claimed a deduction of $5,000 or less. Also list Type of federal return filed is based on your personal tax situation and IRS rules. Form 1040EZ is generally used by single/married taxpayers with taxable income under $100,000, no dependents, no itemized deductions, and certain types of income (including wages, salaries, tips, some scholarships/grants, and unemployment compensation

361 rows · 01/02/2020 · Read IRS instructions online in a browser-friendly format (HTML). Skip to … Form 8283 (Rev. November 2019) Department of the Treasury Internal Revenue Service . Noncash Charitable Contributions Attach one or more Forms 8283 to …

Also, do not use Form 8283 to figure the charitable contribution deduction. Section A: Page 1 of this form must be filled in if the noncash contribution deduction on Schedule A is more than $500, but less than $5000. Also, list certain publicly traded securities even if the deduction is over $5000. See the IRS instructions for more information. Form 8283 (Rev. November 2019) Department of the Treasury Internal Revenue Service . Noncash Charitable Contributions Attach one or more Forms 8283 to …

IRS Form 8283 is required for all non-cash contributions valued at greater than $500. While the land trust’s signature on Form 8283 does not represent agreement with the claimed value, the IRS has asked that land trusts use common sense in questioning appraisals that seem inflated and that land trusts help landowners do the right thing. IRS Tax Map. 2017 Form 941-SS Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands: 2017 Instructions for Form 941-SS, Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands

The IRS should revise the instructions for Form 8283 to more clearly explain when it is required to be filed, given that the instructions state that failure to file the form can cause the deduction to be disallowed in its entirety. Submit electronic version of IRS Instructions 8283 2019 - 2020. Try out PDF blanks, fill them out with required data and put your signature. Edit and print forms in a few clicks. Our user-friendly interface will save your time and effort. Safe and fast!

We last updated the Noncash Charitable Contributions in February 2019, and the latest form we have available is for tax year 2018. This means that we don't yet have the updated form for the current tax year.Please check this page regularly, as we will post the updated form as soon as it is released by the Federal Internal Revenue Service. We last updated the Noncash Charitable Contributions in February 2019, and the latest form we have available is for tax year 2018. This means that we don't yet have the updated form for the current tax year.Please check this page regularly, as we will post the updated form as soon as it is released by the Federal Internal Revenue Service.

Form 8283 is a United States Internal Revenue Service tax form used to report non-cash chartable contributions of over $500 made by an individual or corporate taxpayer. Only use this form for the donation of property, not the donation of time or funds that are cash based. 06/09/2019 · What Is IRS Form 8283? Individuals and organizations who donated non-cash contributions to a certain group must declare said gifts to the IRS if the value of the donated items exceeds $500. In this case, the individual or organization must file Form 8283.

Preparing Form 8283. To complete the remainder of the form, you must have the name and address of all organizations you made donations to, descriptions of all property, information on how you initially acquired the property, the amount you paid for each item and their respective values at … 05/11/2019 · Information about Form 8283, Noncash Charitable Contributions, including recent updates, related forms and instructions on how to file. Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property, the claimed value of which exceeds $500.

The IRS should revise the instructions for Form 8283 to more clearly explain when it is required to be filed, given that the instructions state that failure to file the form can cause the deduction to be disallowed in its entirety. Form 8283 Section A Instructions. For Section A, Part I, only include the following information: Items or groups of similar items (like coin collections, jewelry, or paintings) for which you claimed a deduction of $5,000 or less per item, or for the group of similar items.

Once your donations go over that amount, you’ll need to submit a completed Form 8283 with your tax return. Completing the IRS Form 8283. You use Form 8283 when you make charitable donations that are not in the form of cash. Essentially, anything other than money that you donate throughout the year can be considered eligible for Form 8283. For 26 rows · Instructions for Form 56, Notice Concerning Fiduciary Relationship 1219 12/17/2019 Form …

IMPORTANT: Before opening the umbrella remove the tie string and with you hands on the ribs slightly open the umbrella. To open the umbrella , gently turn the handle (H) of the winch G) clockwise, taking care not to force the mechanism. ∆: the umbrella must only be opened when the closed umbrella is not tilted (perpendicular to the ground). Mimosa cantilever umbrella instructions Haddo Patio Umbrella. 23 Problems and Solutions instructions for replacing lifting rope. Treasure Garden Patio Umbrella AKZ 11 FOOT OCTAGON. 0 Solutions. I have the 11 foot cantilever umbrella. The lever . Treasure Garden Patio Umbrella AKZ. 1 Solutions. I need to restring the cables. Is there a