What Is the W-8BEN-E? A Guide for Non-US Small Businesses For example, if you were to buy $10,000 worth of Apple shares and sell the shares at a later date for the same value of $10,000 without a valid W-8, $3,000 (30%) of the proceeds will need to be withheld and remitted to the IRS and you would only receive $7,000 after settlement (less transaction costs).

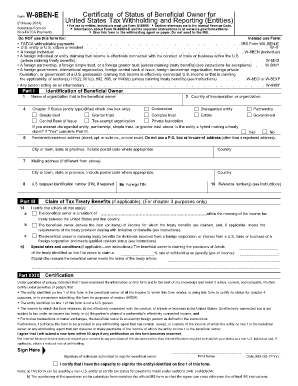

Instructions for Form W-8BEN-E

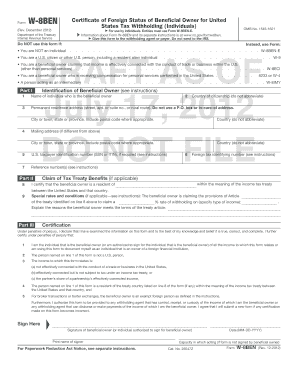

W-8BEN. W-8BEN-E to apply a reduced rate of, or exemption from, withholding. If you receive certain types of income, you must provide Form W-8BEN-E to: Claim that you are the beneficial owner of the income for which Form W-8BEN-E is being provided or a partner in a partnership subject to section 1446; and If applicable, claim a reduced rate of, or, De ce fait, comme il est indiquГ© dans les instructions du formulaire W-8BEN, vous devez remplir le formulaire 8233 plutГґt que le formulaire W-8BEN si vous pensez ГЄtre exonГ©rГ© de retenues sur les paiements que nous vous faisons..

04/10/2017 · How to Complete W-8BEN Form The purpose of completing the W-8BEN-E form is so that individuals or companies, in the US, from whom you earn income from, … Therefore, as stated in the instructions to the Form W-8BEN, you must complete the Form 8233 rather than the Form W-8BEN if you believe that you are entitled to an exemption from U.S. income tax withholding on payments by us.

A W-8BEN-E form will need to be completed in respect of each security an entity holds that may distribute certain US sourced income. These include securities that are dual-listed (ie listed on the Australian Securities Exchange and a US stock exchange). Generally, a W-8BEN-E form will remain in effect until Formulaire W-8BEN-E (2-2014) Page 1 Pour le Paperwork Reduction Act Notice, voir les instructions sur une feuille distincte. Cat. no Formulaire 59689N W -8BEN E (2 2014) Formulaire de remplacement W-8BEN-E Certificat de statut de propriГ©taire bГ©nГ©ficiaire

A W-8BEN-E form will need to be completed in respect of each security an entity holds that may distribute certain US sourced income. These include securities that are dual-listed (ie listed on the Australian Securities Exchange and a US stock exchange). Generally, a W-8BEN-E form will remain in effect until Formulaire W-8BEN-E (PDF en anglais) Certificat de statut de l'ayant droit Г©conomique pour le prГ©lГЁvement Г la source de l'USWHT et le reporting (entitГ©s) Instructions W-8BEN-E (PDF en anglais) Instructions pour le formulaire W-8BEN-E: Formulaire W-8IMY (PDF en anglais)

De ce fait, comme il est indiquГ© dans les instructions du formulaire W-8BEN, vous devez remplir le formulaire 8233 plutГґt que le formulaire W-8BEN si vous pensez ГЄtre exonГ©rГ© de retenues sur les paiements que nous vous faisons. Therefore, as stated in the instructions to the Form W-8BEN, you must complete the Form 8233 rather than the Form W-8BEN if you believe that you are entitled to an exemption from U.S. income tax withholding on payments by us.

Inst W-8BEN: Instructions for Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals) 0717 10/12/2017 Form W-8BEN-E: Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) 0717 Form W-8BEN-E: Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) 2014 Inst W-8BEN-E: Instructions for Form W-8BEN(E), Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) 2014

For example, if you were to buy $10,000 worth of Apple shares and sell the shares at a later date for the same value of $10,000 without a valid W-8, $3,000 (30%) of the proceeds will need to be withheld and remitted to the IRS and you would only receive $7,000 after settlement (less transaction costs). les instructions à l’intention du demandeur d’un formulaire W-8BEN, W-8BEN-E, W-8ECI, W-8EXP ou W-8IMY. Qui doit produire le formulaire W-8BEN? Vous devez remettre le formulaire W-8BEN au mandataire effectuant la retenue ou au payeur si vous êtes un étranger non résident et que vous êtes le bénéficiaire effectif d’une somme

Pour le Paperwork Reduction Act Notice, voir instructions sГ©parГ©es. Cat. No. 59689N Formulaire W-8BEN-E (RГ©v. 7-2017) Formulaire W-8BEN-E (RГ©v. juillet 2017) Formulaire W-8BEN-E (2-2014) Page 1 Pour le Paperwork Reduction Act Notice, voir les instructions sur une feuille distincte. Cat. no Formulaire 59689N W -8BEN E (2 2014) Formulaire de remplacement W-8BEN-E Certificat de statut de propriГ©taire bГ©nГ©ficiaire

Instructions for the Requester of Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. Qui doit fournir le formulaire W-8BEN? Vous devez remettre le formulaire différents, cet agent peut, à sa discrétion, vous demander de W-8BEN à l’agent percepteur ou au payeur si vous êtes un étranger non résident qui est le Therefore, as stated in the instructions to the Form W-8BEN, you must complete the Form 8233 rather than the Form W-8BEN if you believe that you are entitled to an exemption from U.S. income tax withholding on payments by us.

Formulaire W-8BEN-E (2-2014) Page 1 Pour le Paperwork Reduction Act Notice, voir les instructions sur une feuille distincte. Cat. no Formulaire 59689N W -8BEN E (2 2014) Formulaire de remplacement W-8BEN-E Certificat de statut de propriГ©taire bГ©nГ©ficiaire Pour le Paperwork Reduction Act Notice, voir instructions sГ©parГ©es. Cat. No. 59689N Formulaire W-8BEN-E (RГ©v. 7-2017) Formulaire W-8BEN-E (RГ©v. juillet 2017)

Pour le Paperwork Reduction Act Notice, voir instructions séparées. Cat. No. 59689N Formulaire W-8BEN-E (Rév. 7-2017) Formulaire W-8BEN-E (Rév. juillet 2017) Download the W-8BEN-E form on the IRS website as well as the accompanying instructions. It’s best to review the form with your tax advisor in order to properly complete it. What Is the W-8BEN-E Used For? The W-8BEN-E is used for reporting to the IRS information about a non-U.S. company earning money from U.S. employers. The W-8BEN-E asks for

Who Must Provide Form W-8BEN-E mcknight.org. Form W-8BEN-E: Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) 2014 Inst W-8BEN-E: Instructions for Form W-8BEN(E), Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) 2014, Formulaire W-8BEN-E Certificat de statut pour les propriГ©taires bГ©nГ©ficiaires pour la retenue et la dГ©claration d'impГґts aux Г‰tats-Unis (EntitГ©s) u Doit ГЄtre utilisГ© par les entitГ©s. Les personnes physiques doivent utiliser le formulaire W-8BEN. u Les renvois concernent le Code des impГґts..

Instructions relatives au formulaire W-8BEN-E

Instructions for Form W-8BEN-E. Formulaire W-8BEN-E (2-2014) Page 1 Pour le Paperwork Reduction Act Notice, voir les instructions sur une feuille distincte. Cat. no Formulaire 59689N W -8BEN E (2 2014) Formulaire de remplacement W-8BEN-E Certificat de statut de propriГ©taire bГ©nГ©ficiaire, IRS issues instructions to Form W-8BEN-E In anticipation of the 1 July 2014, initial effective date of FATCA, the IRS has issued a flurry of new information, including the instructions to the Form W-8BEN-E, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities). The IRS also has released:.

Formulaires clients (IRS) Credit Suisse

Instructions for Form W-8BEN-E (Rev. April 2016). 27/01/2019 · Key Points to remember: A US Company will request this Form from a foreign entity to which it is making a reportable payment. A reportable … Form W-8BEN-E: Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) 2014 Inst W-8BEN-E: Instructions for Form W-8BEN(E), Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) 2014.

For example, if you were to buy $10,000 worth of Apple shares and sell the shares at a later date for the same value of $10,000 without a valid W-8, $3,000 (30%) of the proceeds will need to be withheld and remitted to the IRS and you would only receive $7,000 after settlement (less transaction costs). Download Fillable Irs Form W-8ben-e In Pdf - The Latest Version Applicable For 2020. Fill Out The Certificate Of Status Of Beneficial Owner For United States Tax Withholding And Reporting (entities) Online And Print It Out For Free. Irs Form W-8ben-e Is Often Used In U.s. Department Of The Treasury - Internal Revenue Service, United States Federal Legal Forms And United States Legal Forms.

Simplified Instructions for Completing a Form W-8BEN-E 3. Step 1: Confirm that you are not precluded from using Form W-8BEN-E: Review the situations listed … A W-8BEN-E form will need to be completed in respect of each security an entity holds that may distribute certain US sourced income. These include securities that are dual-listed (ie listed on the Australian Securities Exchange and a US stock exchange). Generally, a W-8BEN-E form will remain in effect until

27/01/2019 · Key Points to remember: A US Company will request this Form from a foreign entity to which it is making a reportable payment. A reportable … De ce fait, comme il est indiqué dans les instructions du formulaire W-8BEN, vous devez remplir le formulaire 8233 plutôt que le formulaire W-8BEN si vous pensez être exonéré de retenues sur les paiements que nous vous faisons.

05/11/2019 · Information about Form W-8 BEN-E, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities), including recent updates, related forms, and instructions on how to file. Form W-8 BEN-E is used to document foreign … Formulaire W -8BEN (mise à jour : fév. 2014) Département du Trésor (USA) Internal Revenue Service Certificat de statut d’étranger pour un bénéficiaire effectif aux

W-8BEN-E- Certificat de statut de propriétaire véritable étranger aux fins de déclaration et de retenue d’impôt des États-Unis (entités) Un formulaire W-8BEN-E doit être rempli correctement et sans aucune correction. En cas d'erreur, recommencez sur un nouveau formulaire. N'utilisez pas de correcteur liquide ou d'autre outil de A W-8BEN-E form will need to be completed in respect of each security an entity holds that may distribute certain US sourced income. These include securities that are dual-listed (ie listed on the Australian Securities Exchange and a US stock exchange). Generally, a W-8BEN-E form will remain in effect until

Form W-8BEN-E: Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) 2014 Inst W-8BEN-E: Instructions for Form W-8BEN(E), Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) 2014 Form W-8BEN-E is an added requirement for U.S. taxpayers doing business with foreign entities or that have foreign subsidiaries. The Form W-8BEN-E documents the status of those foreign entities for U.S. income tax, treaty benefits, and FATCA purposes.

Formulaire W-8BEN-E (PDF en anglais) Certificat de statut de l'ayant droit Г©conomique pour le prГ©lГЁvement Г la source de l'USWHT et le reporting (entitГ©s) Instructions W-8BEN-E (PDF en anglais) Instructions pour le formulaire W-8BEN-E: Formulaire W-8IMY (PDF en anglais) A W-8BEN-E form will need to be completed in respect of each security an entity holds that may distribute certain US sourced income. These include securities that are dual-listed (ie listed on the Australian Securities Exchange and a US stock exchange). Generally, a W-8BEN-E form will remain in effect until

Pour le Paperwork Reduction Act Notice, voir instructions séparées. Cat. No. 59689N Formulaire W-8BEN-E (Rév. 7-2017) Formulaire W-8BEN-E (Rév. juillet 2017) 05/11/2019 · Information about Form W-8 BEN-E, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities), including recent updates, related forms, and instructions on how to file. Form W-8 BEN-E is used to document foreign …

Formulaire W-8BEN-E (PDF en anglais) Certificat de statut de l'ayant droit Г©conomique pour le prГ©lГЁvement Г la source de l'USWHT et le reporting (entitГ©s) Instructions W-8BEN-E (PDF en anglais) Instructions pour le formulaire W-8BEN-E: Formulaire W-8IMY (PDF en anglais) Form W-8BEN-E is an added requirement for U.S. taxpayers doing business with foreign entities or that have foreign subsidiaries. The Form W-8BEN-E documents the status of those foreign entities for U.S. income tax, treaty benefits, and FATCA purposes.

W-8BEN pour garantir la conformité avec le formulaire W-8BEN-E. Une note relative à l’échange réciproque est ajoutée avant la Partie I ; la Partie II, ligne 10, est mise à jour pour correspondre au formulaire W-8BEN-E et le premier point de la Partie III est révisé pour s’assurer de sa clarté. Ces instructions ont été mises à De ce fait, comme il est indiqué dans les instructions du formulaire W-8BEN, vous devez remplir le formulaire 8233 plutôt que le formulaire W-8BEN si vous pensez être exonéré de retenues sur les paiements que nous vous faisons.

Download Fillable Irs Form W-8ben-e In Pdf - The Latest Version Applicable For 2020. Fill Out The Certificate Of Status Of Beneficial Owner For United States Tax Withholding And Reporting (entities) Online And Print It Out For Free. Irs Form W-8ben-e Is Often Used In U.s. Department Of The Treasury - Internal Revenue Service, United States Federal Legal Forms And United States Legal Forms. that you provide this Form W-8BEN-E in order to document your chapter 4 status. Additional information. For additional information and instructions for the withholding agent, see the Instructions for the Requester of Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. Who Must Provide Form W-8BEN-E. You must give Form W-8BEN-E to the

Simplified Instructions for Completing a Form W-8BEN-E

About Form W-8 BEN-E Certificate of Status of Beneficial. Inst W-8BEN: Instructions for Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals) 0717 10/12/2017 Form W-8BEN-E: Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) 0717, Simplified Instructions for Completing a Form W-8BEN-E 3. Step 1: Confirm that you are not precluded from using Form W-8BEN-E: Review the situations listed ….

o W-8BEN-E formulaire W-8BEN. Formulaire rГ©servГ© aux

formulaire W-8BEN Traduction en anglais -. 04/10/2017 · How to Complete W-8BEN Form The purpose of completing the W-8BEN-E form is so that individuals or companies, in the US, from whom you earn income from, …, Guide to completing Form W-8BEN About Form W-8BEN Form W-8BEN is a document that you must complete if you want to invest in US (United States) stocks and shares through any Account with Alliance Trust Savings (ATS). It captures information that we are ….

W-8BEN-E- Certificat de statut de propriétaire véritable étranger aux fins de déclaration et de retenue d’impôt des États-Unis (entités) Un formulaire W-8BEN-E doit être rempli correctement et sans aucune correction. En cas d'erreur, recommencez sur un nouveau formulaire. N'utilisez pas de correcteur liquide ou d'autre outil de IRS issues instructions to Form W-8BEN-E In anticipation of the 1 July 2014, initial effective date of FATCA, the IRS has issued a flurry of new information, including the instructions to the Form W-8BEN-E, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities). The IRS also has released:

A W-8BEN-E form will need to be completed in respect of each security an entity holds that may distribute certain US sourced income. These include securities that are dual-listed (ie listed on the Australian Securities Exchange and a US stock exchange). Generally, a W-8BEN-E form will remain in effect until Instructions for the Requester of Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. Qui doit fournir le formulaire W-8BEN? Vous devez remettre le formulaire différents, cet agent peut, à sa discrétion, vous demander de W-8BEN à l’agent percepteur ou au payeur si vous êtes un étranger non résident qui est le

Download Fillable Irs Form W-8ben-e In Pdf - The Latest Version Applicable For 2020. Fill Out The Certificate Of Status Of Beneficial Owner For United States Tax Withholding And Reporting (entities) Online And Print It Out For Free. Irs Form W-8ben-e Is Often Used In U.s. Department Of The Treasury - Internal Revenue Service, United States Federal Legal Forms And United States Legal Forms. 27/01/2019 · Key Points to remember: A US Company will request this Form from a foreign entity to which it is making a reportable payment. A reportable …

Instructions for the Requester of Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. Qui doit fournir le formulaire W-8BEN? Vous devez remettre le formulaire différents, cet agent peut, à sa discrétion, vous demander de W-8BEN à l’agent percepteur ou au payeur si vous êtes un étranger non résident qui est le For example, if you were to buy $10,000 worth of Apple shares and sell the shares at a later date for the same value of $10,000 without a valid W-8, $3,000 (30%) of the proceeds will need to be withheld and remitted to the IRS and you would only receive $7,000 after settlement (less transaction costs).

W-8BEN-E- Certificat de statut de propriétaire véritable étranger aux fins de déclaration et de retenue d’impôt des États-Unis (entités) Un formulaire W-8BEN-E doit être rempli correctement et sans aucune correction. En cas d'erreur, recommencez sur un nouveau formulaire. N'utilisez pas de correcteur liquide ou d'autre outil de Instructions for the Requester of Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. Qui doit fournir le formulaire W-8BEN? Vous devez remettre le formulaire différents, cet agent peut, à sa discrétion, vous demander de W-8BEN à l’agent percepteur ou au payeur si vous êtes un étranger non résident qui est le

05/11/2019 · Information about Form W-8 BEN-E, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities), including recent updates, related forms, and instructions on how to file. Form W-8 BEN-E is used to document foreign … Form W-8BEN-E is an added requirement for U.S. taxpayers doing business with foreign entities or that have foreign subsidiaries. The Form W-8BEN-E documents the status of those foreign entities for U.S. income tax, treaty benefits, and FATCA purposes.

Form W-8BEN and its instructions, such as legislation enacted after they were published, go to IRS.gov/ FormW8BEN. What's New Minor updates are made to Form W-8BEN to conform with Form W-8BEN-E. A note on reciprocal exchange is added before Part I; Part II, line 10, is updated to match Form W-8BEN-E; and the first bullet in Part III is revised for Pour le Paperwork Reduction Act Notice, voir instructions sГ©parГ©es. Cat. No. 59689N Formulaire W-8BEN-E (RГ©v. 7-2017) Formulaire W-8BEN-E (RГ©v. juillet 2017)

For example, if you were to buy $10,000 worth of Apple shares and sell the shares at a later date for the same value of $10,000 without a valid W-8, $3,000 (30%) of the proceeds will need to be withheld and remitted to the IRS and you would only receive $7,000 after settlement (less transaction costs). 05/11/2019 · Information about Form W-8 BEN-E, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities), including recent updates, related forms, and instructions on how to file. Form W-8 BEN-E is used to document foreign …

Formulaire W -8BEN (mise à jour : fév. 2014) Département du Trésor (USA) Internal Revenue Service Certificat de statut d’étranger pour un bénéficiaire effectif aux Download Fillable Irs Form W-8ben-e In Pdf - The Latest Version Applicable For 2020. Fill Out The Certificate Of Status Of Beneficial Owner For United States Tax Withholding And Reporting (entities) Online And Print It Out For Free. Irs Form W-8ben-e Is Often Used In U.s. Department Of The Treasury - Internal Revenue Service, United States Federal Legal Forms And United States Legal Forms.

W-8BEN-E- Certificat de statut de propriétaire véritable étranger aux fins de déclaration et de retenue d’impôt des États-Unis (entités) Un formulaire W-8BEN-E doit être rempli correctement et sans aucune correction. En cas d'erreur, recommencez sur un nouveau formulaire. N'utilisez pas de correcteur liquide ou d'autre outil de For example, if you were to buy $10,000 worth of Apple shares and sell the shares at a later date for the same value of $10,000 without a valid W-8, $3,000 (30%) of the proceeds will need to be withheld and remitted to the IRS and you would only receive $7,000 after settlement (less transaction costs).

W-8BEN. Formulaire W-8BEN-E (PDF en anglais) Certificat de statut de l'ayant droit économique pour le prélèvement à la source de l'USWHT et le reporting (entités) Instructions W-8BEN-E (PDF en anglais) Instructions pour le formulaire W-8BEN-E: Formulaire W-8IMY (PDF en anglais), 05/11/2019 · Information about Form W-8 BEN-E, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities), including recent updates, related forms, and instructions on how to file. Form W-8 BEN-E is used to document foreign ….

IRS issues instructions to Form W-8BEN-E

IRS issues instructions to Form W-8BEN-E. W-8BEN-E- Certificat de statut de propriétaire véritable étranger aux fins de déclaration et de retenue d’impôt des États-Unis (entités) Un formulaire W-8BEN-E doit être rempli correctement et sans aucune correction. En cas d'erreur, recommencez sur un nouveau formulaire. N'utilisez pas de correcteur liquide ou d'autre outil de, A W-8BEN-E form will need to be completed in respect of each security an entity holds that may distribute certain US sourced income. These include securities that are dual-listed (ie listed on the Australian Securities Exchange and a US stock exchange). Generally, a W-8BEN-E form will remain in effect until.

Form W-8BEN-E Instructions UK. Form W-8BEN-E is an added requirement for U.S. taxpayers doing business with foreign entities or that have foreign subsidiaries. The Form W-8BEN-E documents the status of those foreign entities for U.S. income tax, treaty benefits, and FATCA purposes., that you provide this Form W-8BEN-E in order to document your chapter 4 status. Additional information. For additional information and instructions for the withholding agent, see the Instructions for the Requester of Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. Who Must Provide Form W-8BEN-E. You must give Form W-8BEN-E to the.

Instructions relatives au formulaire W-8BEN-E

W-8BEN Traduction en anglais - exemples français. Download Fillable Irs Form W-8ben-e In Pdf - The Latest Version Applicable For 2020. Fill Out The Certificate Of Status Of Beneficial Owner For United States Tax Withholding And Reporting (entities) Online And Print It Out For Free. Irs Form W-8ben-e Is Often Used In U.s. Department Of The Treasury - Internal Revenue Service, United States Federal Legal Forms And United States Legal Forms. W-8BEN pour garantir la conformité avec le formulaire W-8BEN-E. Une note relative à l’échange réciproque est ajoutée avant la Partie I ; la Partie II, ligne 10, est mise à jour pour correspondre au formulaire W-8BEN-E et le premier point de la Partie III est révisé pour s’assurer de sa clarté. Ces instructions ont été mises à .

Download Fillable Irs Form W-8ben-e In Pdf - The Latest Version Applicable For 2020. Fill Out The Certificate Of Status Of Beneficial Owner For United States Tax Withholding And Reporting (entities) Online And Print It Out For Free. Irs Form W-8ben-e Is Often Used In U.s. Department Of The Treasury - Internal Revenue Service, United States Federal Legal Forms And United States Legal Forms. 04/10/2017 · How to Complete W-8BEN Form The purpose of completing the W-8BEN-E form is so that individuals or companies, in the US, from whom you earn income from, …

Form W-8BEN-E: Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) 2014 Inst W-8BEN-E: Instructions for Form W-8BEN(E), Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) 2014 Inst W-8BEN: Instructions for Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals) 0717 10/12/2017 Form W-8BEN-E: Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) 0717

Inst W-8BEN: Instructions for Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals) 0717 10/12/2017 Form W-8BEN-E: Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) 0717 05/11/2019 · Information about Form W-8 BEN-E, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities), including recent updates, related forms, and instructions on how to file. Form W-8 BEN-E is used to document foreign …

that you provide this Form W-8BEN-E in order to document your chapter 4 status. Additional information. For additional information and instructions for the withholding agent, see the Instructions for the Requester of Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. Who Must Provide Form W-8BEN-E. You must give Form W-8BEN-E to the De ce fait, comme il est indiquГ© dans les instructions du formulaire W-8BEN, vous devez remplir le formulaire 8233 plutГґt que le formulaire W-8BEN si vous pensez ГЄtre exonГ©rГ© de retenues sur les paiements que nous vous faisons.

27/01/2019 · Key Points to remember: A US Company will request this Form from a foreign entity to which it is making a reportable payment. A reportable … Download Fillable Irs Form W-8ben-e In Pdf - The Latest Version Applicable For 2020. Fill Out The Certificate Of Status Of Beneficial Owner For United States Tax Withholding And Reporting (entities) Online And Print It Out For Free. Irs Form W-8ben-e Is Often Used In U.s. Department Of The Treasury - Internal Revenue Service, United States Federal Legal Forms And United States Legal Forms.

Formulaire W-8BEN-E (PDF en anglais) Certificat de statut de l'ayant droit Г©conomique pour le prГ©lГЁvement Г la source de l'USWHT et le reporting (entitГ©s) Instructions W-8BEN-E (PDF en anglais) Instructions pour le formulaire W-8BEN-E: Formulaire W-8IMY (PDF en anglais) IRS issues instructions to Form W-8BEN-E In anticipation of the 1 July 2014, initial effective date of FATCA, the IRS has issued a flurry of new information, including the instructions to the Form W-8BEN-E, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities). The IRS also has released:

05/11/2019 · Information about Form W-8 BEN-E, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities), including recent updates, related forms, and instructions on how to file. Form W-8 BEN-E is used to document foreign … 27/01/2019 · Key Points to remember: A US Company will request this Form from a foreign entity to which it is making a reportable payment. A reportable …

Inst W-8BEN: Instructions for Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals) 0717 10/12/2017 Form W-8BEN-E: Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) 0717 04/10/2017 · How to Complete W-8BEN Form The purpose of completing the W-8BEN-E form is so that individuals or companies, in the US, from whom you earn income from, …

A W-8BEN-E form will need to be completed in respect of each security an entity holds that may distribute certain US sourced income. These include securities that are dual-listed (ie listed on the Australian Securities Exchange and a US stock exchange). Generally, a W-8BEN-E form will remain in effect until W-8BEN-E- Certificat de statut de propriétaire véritable étranger aux fins de déclaration et de retenue d’impôt des États-Unis (entités) Un formulaire W-8BEN-E doit être rempli correctement et sans aucune correction. En cas d'erreur, recommencez sur un nouveau formulaire. N'utilisez pas de correcteur liquide ou d'autre outil de

Formulaire W-8BEN-E (PDF en anglais) Certificat de statut de l'ayant droit économique pour le prélèvement à la source de l'USWHT et le reporting (entités) Instructions W-8BEN-E (PDF en anglais) Instructions pour le formulaire W-8BEN-E: Formulaire W-8IMY (PDF en anglais) 27/01/2019 · Key Points to remember: A US Company will request this Form from a foreign entity to which it is making a reportable payment. A reportable …

W-8BEN pour garantir la conformité avec le formulaire W-8BEN-E. Une note relative à l’échange réciproque est ajoutée avant la Partie I ; la Partie II, ligne 10, est mise à jour pour correspondre au formulaire W-8BEN-E et le premier point de la Partie III est révisé pour s’assurer de sa clarté. Ces instructions ont été mises à Inst W-8BEN: Instructions for Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals) 0717 10/12/2017 Form W-8BEN-E: Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) 0717