Welcome to our comprehensive guide on life insurance, where we unravel its complexities and unlock the secrets to securing your future. Life insurance is a cornerstone of financial planning, offering peace of mind and protection for your loved ones.

1.1 Understanding the Basics of Life Insurance

Life insurance is a contractual agreement between an individual and an insurer, providing financial protection in the event of death or disability. It serves as a safety net, ensuring your loved ones are supported financially. Policies typically require premium payments, and in return, the insurer promises a death benefit payout. Understanding the basics involves grasping key concepts like coverage types, policy terms, and beneficiary designations. Life insurance offers peace of mind, knowing that unexpected events won’t burden your family financially. It’s a fundamental tool for safeguarding your family’s future and achieving long-term financial security.

1.2 The Importance of Life Insurance in Financial Planning

Life insurance plays a pivotal role in financial planning, serving as a cornerstone for securing your family’s future. It provides a financial safety net, ensuring loved ones can maintain their lifestyle even in your absence. By covering funeral expenses, outstanding debts, and income replacement, life insurance safeguards against financial instability. Additionally, it offers tax-free benefits and can serve as an inheritance for future generations. Integrating life insurance into your financial strategy ensures comprehensive protection, aligning with your long-term goals and offering peace of mind; It is an essential tool for building a secure and resilient financial foundation.

Types of Life Insurance Policies

Life insurance offers various policy types to suit individual needs, including term, whole, and universal life insurance. Each provides unique benefits, flexibility, and coverage durations.

2.1 Term Life Insurance: Features and Benefits

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. It is often more affordable than whole life insurance, offering lower premiums for the same death benefit. A key feature is its flexibility, allowing policyholders to choose a term that aligns with their financial obligations, like mortgages or raising children. At the end of the term, policyholders can renew, convert to a permanent policy, or discontinue coverage. This type of insurance is ideal for those needing temporary protection, making it a popular choice for young families and individuals with short-term financial responsibilities.

2.2 Whole Life Insurance: Permanent Coverage Explained

Whole life insurance offers permanent coverage for the entirety of your life, as long as premiums are paid. It combines a guaranteed death benefit with a cash value component that grows over time. This policy is ideal for long-term financial goals, such as funeral expenses or estate planning. The cash value can be borrowed against or used to pay premiums later in life. While more expensive than term life insurance, whole life provides lifetime protection and a guaranteed rate of return, making it a reliable choice for those seeking enduring financial security.

2.3 Universal Life Insurance: Flexibility and Adaptability

Universal life insurance (UL) offers unparalleled flexibility and adaptability, making it ideal for those with evolving financial needs. Unlike whole life insurance, UL allows you to adjust premiums, death benefits, and investment options. The policy includes a cash value component that grows based on market performance or a guaranteed minimum rate. You can borrow against the cash value or use it to pay premiums, providing tax-deferred growth. This versatility makes UL a popular choice for individuals seeking a balance between protection and investment potential, with the freedom to tailor coverage as life circumstances change over time.

How to Choose the Right Life Insurance Policy

Assess your financial needs and goals to determine the ideal coverage. Compare policies, considering premiums, terms, and benefits to ensure alignment with your future plans.

3.1 Assessing Your Financial Needs and Goals

Assessing your financial needs and goals is the first step in choosing the right life insurance policy. Consider your income, dependents, and outstanding debts. Evaluate how much coverage is needed to maintain your family’s lifestyle and secure their future. Think about long-term objectives, such as funding your children’s education or ensuring a comfortable retirement for your spouse. Align your policy choice with these factors to ensure it meets your unique circumstances and provides lasting protection. This evaluation will guide you in selecting a policy that offers both affordability and comprehensive coverage.

3.2 Comparing Policy Terms and Premiums

Comparing policy terms and premiums is crucial for selecting the best life insurance coverage. Evaluate the coverage period, death benefit, and premium rates to ensure they align with your needs. Consider whether the policy offers flexibility to adjust coverage or premiums over time. Consider riders and add-ons that customize your policy. Compare quotes from multiple providers to find the most affordable and comprehensive option. Ensure you understand the fine print, including any exclusions or limitations. This thorough comparison will help you make an informed decision and secure the right protection for your family’s future.

Life Insurance Riders and Add-Ons

Life insurance riders and add-ons enhance your policy by offering additional benefits, such as waiver of premium or accelerated death benefit. They provide flexibility to tailor coverage to your needs.

4.1 Common Riders to Enhance Your Policy

Life insurance riders are additional features that can be added to your policy to customize your coverage. One popular rider is the wavier of premium, which suspends premium payments if you become disabled or critically ill. Another is the accelerated death benefit, allowing you to receive a portion of the payout while alive if diagnosed with a terminal illness. Long-term care riders enable you to use policy benefits for caregiving expenses. These riders provide flexibility and enhance protection, ensuring your policy adapts to life’s changing circumstances. They are valuable additions for those seeking tailored coverage.

4.2 How Add-Ons Can Customize Your Coverage

Add-ons are optional features that allow you to tailor your life insurance policy to meet specific needs. For instance, a child protection rider provides coverage for your children, while a long-term care rider enables you to use policy benefits for caregiving expenses. Other add-ons, like accidental death benefit or income protection, offer additional payouts under certain circumstances. These enhancements provide flexibility, ensuring your policy adapts to life changes and personal goals. By selecting the right add-ons, you can create a policy that aligns with your unique financial and family situation, offering comprehensive protection and peace of mind.

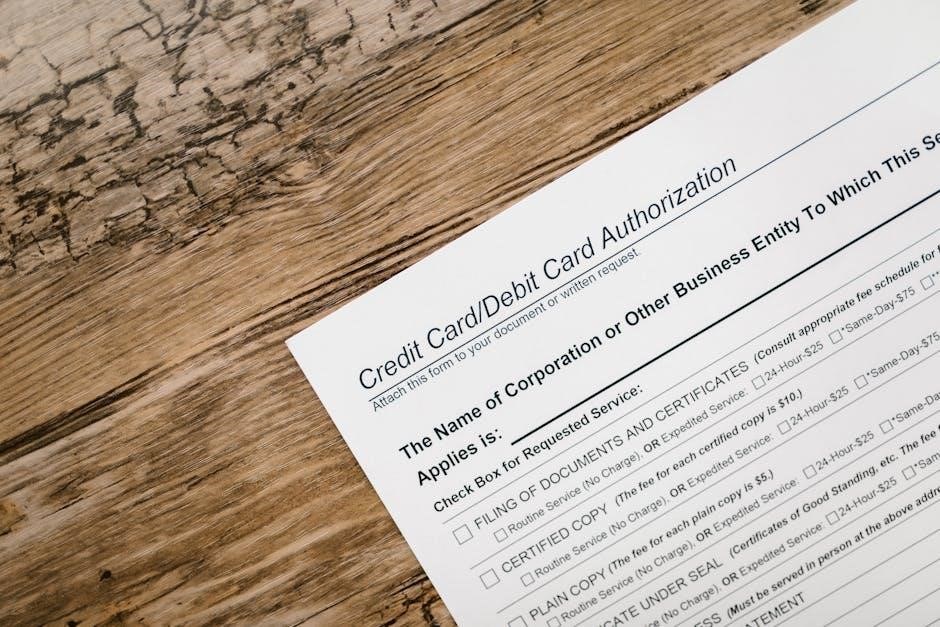

The Process of Buying Life Insurance

Purchasing life insurance involves assessing needs, choosing a policy type, and completing an application. A medical exam and underwriting follow to finalize coverage and determine premiums.

5.1 Steps to Apply for a Life Insurance Policy

Applying for life insurance involves several straightforward steps. First, assess your financial needs to determine coverage requirements. Next, research and compare policies to select the most suitable option. Gather necessary documents, such as identification and medical records. Complete the application form accurately, ensuring all details are correct. A medical exam may be required, and underwriting will review your application. Once approved, review the policy terms and pay the initial premium to activate coverage. This process ensures a smooth and informed experience, helping you secure protection for your loved ones.

5.2 Understanding Medical Exams and Underwriting

Medical exams and underwriting are critical steps in the life insurance process. A medical exam assesses your health, including blood and urine tests, to evaluate risk factors. Underwriters then analyze this data, along with your age, lifestyle, and family history, to determine your premium. The exam ensures accurate risk assessment, while underwriting aligns coverage with your health profile. Some policies offer simplified underwriting or no exams, especially for lower coverage amounts, streamlining the process for eligible applicants.

Life Insurance Claims and Payouts

Welcome to our section on Life Insurance Claims and Payouts. Learn how to file a claim, understand tax implications, and ensure your beneficiaries receive the benefits seamlessly.

6.1 How to File a Life Insurance Claim

Filing a life insurance claim is a straightforward process that ensures your beneficiaries receive the intended benefits. First, notify the insurance provider about the policyholder’s passing and request the necessary forms. Submit the completed claim form along with required documents, such as the policy document and death certificate. The insurer will review the claim and verify the details. Once approved, the payout is typically made according to the policy’s terms. If the process seems complex, consider reaching out to the insurance agent or company representative for guidance to ensure a smooth experience.

6.2 Tax Implications and Benefits of Life Insurance Payouts

Life insurance payouts are generally tax-free for beneficiaries, providing a financial safety net without additional tax burdens. The death benefit is typically excluded from taxable income, ensuring your loved ones receive the full amount intended. However, if the policy is part of the insured’s estate, it may be subject to estate taxes. Additionally, cash value growth in permanent life insurance policies is tax-deferred, meaning you won’t pay taxes on the gains until withdrawal. Consulting a tax professional is recommended to navigate specific scenarios and maximize the benefits of your life insurance policy.

Common Mistakes to Avoid

Avoiding common mistakes like policy lapses, underinsurance, and not reviewing coverage regularly ensures your life insurance remains effective. Always assess your needs and avoid unrealistic expectations about coverage costs.

7.1 Misconceptions About Life Insurance Coverage

Many misconceptions surround life insurance, often preventing individuals from making informed decisions. One common myth is that life insurance is only for older individuals or those with families. In reality, life insurance can benefit anyone with financial dependents or long-term obligations. Another misconception is that coverage is overly expensive, but policies like term life insurance offer affordable options. Some believe that a basic plan through work is sufficient, but this may not provide adequate coverage for all needs. Understanding these myths helps ensure you choose the right policy for your situation.

7.2 Avoiding Policy Lapses and Underinsurance

Avoiding policy lapses and underinsurance is crucial to maintaining adequate coverage. Missed payments can lead to policy lapses, leaving loved ones unprotected. Regularly review premium payments and communicate with your insurer to address any issues promptly. Underinsurance occurs when coverage doesn’t match your financial obligations, such as mortgages or dependents. Periodically assess your policy to ensure it aligns with life changes, like new family members or increased debt. Adjusting your coverage as needed helps prevent gaps and ensures your policy remains relevant and effective over time.

Life insurance is a cornerstone of financial planning, ensuring peace of mind and security for your loved ones. Take action today to protect their future;

8.1 The Role of Life Insurance in Securing Your Future

Life insurance plays a vital role in securing your future by providing a financial safety net for your loved ones. It ensures that dependents are protected from unforeseen events, offering coverage for funeral expenses, outstanding debts, and even future educational needs. Beyond protection, life insurance can serve as a long-term investment, with some policies offering cash value growth over time. By investing in life insurance, you create a legacy of security and peace of mind, safeguarding your family’s well-being and helping them thrive even in your absence.

8.2 Encouragement to Take Action and Protect Your Loved Ones

Don’t wait—take the first step today to safeguard your loved ones’ future. Life insurance is more than a policy; it’s a promise of protection and peace of mind. By investing in coverage, you ensure that your family can thrive even in unexpected circumstances. Secure their financial well-being, cover final expenses, and leave a lasting legacy. The time to act is now—your loved ones deserve the assurance of a secure tomorrow. Make the proactive choice to shield them from life’s uncertainties and create a foundation of stability that will endure for generations.